Published on Nov 28, 2019

By PTI

Share

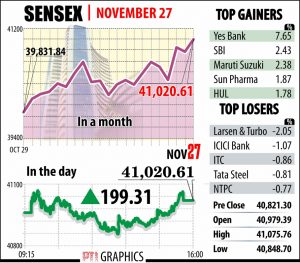

Mumbai, Nov. 27 (PTI): Market benchmark Sensex and Nifty on Wednesday scaled fresh closing peaks on hectic buying in banking, oil & gas and auto stocks amid positive trends from global markets as investors latched onto hopes of a trade deal between the US and China.

The 30-share Sensex rose by 199.31 points or 0.49 per cent to end at a new life-time high of 41,020.61 as 24 of its constituents ended in the green.

The broader NSE Nifty gained 63 points or 0.52 per cent to settle at a new peak of 12,100.70.

According to analysts, sustained foreign fund inflow also buoyed the market sentiment. Foreign investors purchased shares worth Rs 4,677.75 crore on a net basis on Tuesday, provisional exchange data showed.

Banking stocks advanced on rising expectations of a rate cut by the RBI.

Yes Bank was the biggest gainer in the Sensex pack, rallying 7.65 per cent. SBI rose by 2.43 per cent after SBI Cards filed its IPO papers with SEBI. Kotak Bank was up 1 per cent, and IndusInd Bank by 0.64 per cent. HDFC gained 1.41 per cent at the close while HDFC Bank edged up 0.29 per cent.

Among other major gainers, SBI rose by 2.43 per cent, Maruti by 2.38 per cent, Sun Pharma by 1.87 per cent, HUL by 1.78 per cent and ONGC by 1.72 per cent. Tata Motors, Bajaj Auto and Hero MotoCorp rose more than 1 per cent. Infosys, HCL Tech, Reliance Industries and Vedanta Ltd also gained.

Growing hopes that the US and China may soon reach an agreement to settle their trade disputes drove the market sentiment in global markets. US President Donald Trump said the talks were "in the final throes".

"Market was cheerful with the hope that the government will consider new scrappage policy while metals were positive about developments of the first phase US-China trade deal. Rate sensitive stocks like banks did well in expectation of rate cut in RBI policy," Vinod Nair, Head of Research at Geojit Financial Services said.

Short-covering ahead of the expiry of November derivatives contracts on Thursday also contributed to the rally, traders said.

Paras Bothra, President of Equity Research, Ashika Stock Broking said, "Domestic markets were volatile but eventually ended with gains led by positive global cues over US-China trade deal while F&O expiry and upcoming GDP data kept scepticism alive."

L&T was the top loser among Sensex stocks, ending 2.05 per cent lower. ICICI Bank, ITC, Tata Steel, NTPC and Axis Bank too closed in the red.

Broader BSE midcap and smallcap advanced up to 0.82 per cent.

Sectorally, BSE auto, oil and gas, basic materials, metal, energy and healthcare indices ended up to 1.22 per cent higher.

Most of the Asian markets were up on expectations of the US-China trade deal. Hong Kong gained 0.2 per cent, Tokyo rose by 0.3 per cent and Sydney by 0.9 per cent. However, Shanghai settled lower.

Gold falls by INR 35; silver prices gain INR 147

Gold prices fell by INR 35 to INR 38,503 per 10 gram in the national capital on Wednesday due to appreciation in rupee, according to HDFC Securities.

The precious metal had closed at INR 38,538 per 10 gram on Tuesday.

Silver prices, however, rose by INR 147 to INR INR,345 per kg from INR 45,198 per kg in the previous day's trade.

"Spot gold for 24 Karat in Delhi was trading down INR 35 on rupee appreciation. The spot rupee gained for the second day in a row, appreciating around 15 paise against the dollar during the day," HDFC Securities Senior Analyst (Commodities) Tapan Patel said.

The Indian rupee appreciated by 10 paise to 71.40 against the US dollar in early trade on Wednesday as positive opening in domestic equities and sustained foreign fund inflows strengthened investor sentiments.

In the global market, both gold and silver were quoting lower at USD 1,459 per ounce and USD 17.02 per ounce, respectively.

"Gold prices traded weak on Wednesday with international spot gold prices paring previous gains and declined to USD 1,459 an ounce on positive news from US-China trade talks," Patel said.

Rupee settles 15 paise higher at 71.35 against US dollar

The Indian rupee settled 15 paise higher at 71.35 against the US dollar on Wednesday, as gains in domestic equities and sustained foreign fund inflows strengthened investor sentiments.

Forex traders said the rupee appreciated for the second straight day on foreign inflows in primary as well as secondary equity market.

At the interbank foreign exchange market, the rupee opened strong at 71.43 against the US dollar. During the day, the domestic unit fluctuated between a high of 71.30 and a low of 71.48.

The rupee finally settled at 71.35, up 15 paise over its previous close.

The local unit had closed at 71.50 against the US dollar on Tuesday.

This is the second straight session of gain for the domestic currency during which it has appreciated by 39 paise.

Mumbai, Nov. 27 (PTI): Market benchmark Sensex and Nifty on Wednesday scaled fresh closing peaks on hectic buying in banking, oil & gas and auto stocks amid positive trends from global markets as investors latched onto hopes of a trade deal between the US and China.

The 30-share Sensex rose by 199.31 points or 0.49 per cent to end at a new life-time high of 41,020.61 as 24 of its constituents ended in the green.

The broader NSE Nifty gained 63 points or 0.52 per cent to settle at a new peak of 12,100.70.

According to analysts, sustained foreign fund inflow also buoyed the market sentiment. Foreign investors purchased shares worth Rs 4,677.75 crore on a net basis on Tuesday, provisional exchange data showed.

Banking stocks advanced on rising expectations of a rate cut by the RBI.

Yes Bank was the biggest gainer in the Sensex pack, rallying 7.65 per cent. SBI rose by 2.43 per cent after SBI Cards filed its IPO papers with SEBI. Kotak Bank was up 1 per cent, and IndusInd Bank by 0.64 per cent. HDFC gained 1.41 per cent at the close while HDFC Bank edged up 0.29 per cent.

Among other major gainers, SBI rose by 2.43 per cent, Maruti by 2.38 per cent, Sun Pharma by 1.87 per cent, HUL by 1.78 per cent and ONGC by 1.72 per cent. Tata Motors, Bajaj Auto and Hero MotoCorp rose more than 1 per cent. Infosys, HCL Tech, Reliance Industries and Vedanta Ltd also gained.

Growing hopes that the US and China may soon reach an agreement to settle their trade disputes drove the market sentiment in global markets. US President Donald Trump said the talks were "in the final throes".

"Market was cheerful with the hope that the government will consider new scrappage policy while metals were positive about developments of the first phase US-China trade deal. Rate sensitive stocks like banks did well in expectation of rate cut in RBI policy," Vinod Nair, Head of Research at Geojit Financial Services said.

Short-covering ahead of the expiry of November derivatives contracts on Thursday also contributed to the rally, traders said.

Paras Bothra, President of Equity Research, Ashika Stock Broking said, "Domestic markets were volatile but eventually ended with gains led by positive global cues over US-China trade deal while F&O expiry and upcoming GDP data kept scepticism alive."

L&T was the top loser among Sensex stocks, ending 2.05 per cent lower. ICICI Bank, ITC, Tata Steel, NTPC and Axis Bank too closed in the red.

Broader BSE midcap and smallcap advanced up to 0.82 per cent.

Sectorally, BSE auto, oil and gas, basic materials, metal, energy and healthcare indices ended up to 1.22 per cent higher.

Most of the Asian markets were up on expectations of the US-China trade deal. Hong Kong gained 0.2 per cent, Tokyo rose by 0.3 per cent and Sydney by 0.9 per cent. However, Shanghai settled lower.

Gold falls by INR 35; silver prices gain INR 147

Gold prices fell by INR 35 to INR 38,503 per 10 gram in the national capital on Wednesday due to appreciation in rupee, according to HDFC Securities.

The precious metal had closed at INR 38,538 per 10 gram on Tuesday.

Silver prices, however, rose by INR 147 to INR INR,345 per kg from INR 45,198 per kg in the previous day's trade.

"Spot gold for 24 Karat in Delhi was trading down INR 35 on rupee appreciation. The spot rupee gained for the second day in a row, appreciating around 15 paise against the dollar during the day," HDFC Securities Senior Analyst (Commodities) Tapan Patel said.

The Indian rupee appreciated by 10 paise to 71.40 against the US dollar in early trade on Wednesday as positive opening in domestic equities and sustained foreign fund inflows strengthened investor sentiments.

In the global market, both gold and silver were quoting lower at USD 1,459 per ounce and USD 17.02 per ounce, respectively.

"Gold prices traded weak on Wednesday with international spot gold prices paring previous gains and declined to USD 1,459 an ounce on positive news from US-China trade talks," Patel said.

Rupee settles 15 paise higher at 71.35 against US dollar

The Indian rupee settled 15 paise higher at 71.35 against the US dollar on Wednesday, as gains in domestic equities and sustained foreign fund inflows strengthened investor sentiments.

Forex traders said the rupee appreciated for the second straight day on foreign inflows in primary as well as secondary equity market.

At the interbank foreign exchange market, the rupee opened strong at 71.43 against the US dollar. During the day, the domestic unit fluctuated between a high of 71.30 and a low of 71.48.

The rupee finally settled at 71.35, up 15 paise over its previous close.

The local unit had closed at 71.50 against the US dollar on Tuesday.

This is the second straight session of gain for the domestic currency during which it has appreciated by 39 paise.