Share

Read below: Capital markets becoming prominent in India's growth story: Eco Survey

NEW DELHI — Increased foreign direct investment inflows from China can help increase India’s global supply chain participation and push exports, says the Economic Survey.

The Survey said as India looks to deepen its involvement in global value chains (GVCs), it needs to look at the successes and strategies of East Asian economies.

VIDEO | Parliament Budget Session: "A lot of steps have been taken on Ease of Doing Business. Nearly 11 steps have been mentioned in the reply, but most importantly decriminalisation of 63 major offences and as a result of which companies today are able to carry on their… pic.twitter.com/JFzQozOnyG

— Press Trust of India (@PTI_News) July 22, 2024

These economies have typically pursued two main strategies - reducing trade costs and facilitating foreign investment.

Also read: Finance Minister Sitharaman tables Economic Survey 2023-24 in LS

It added that India faces two choices to benefit from 'China plus one' strategy and that is either to integrate into China's supply chain or promote FDI from China.

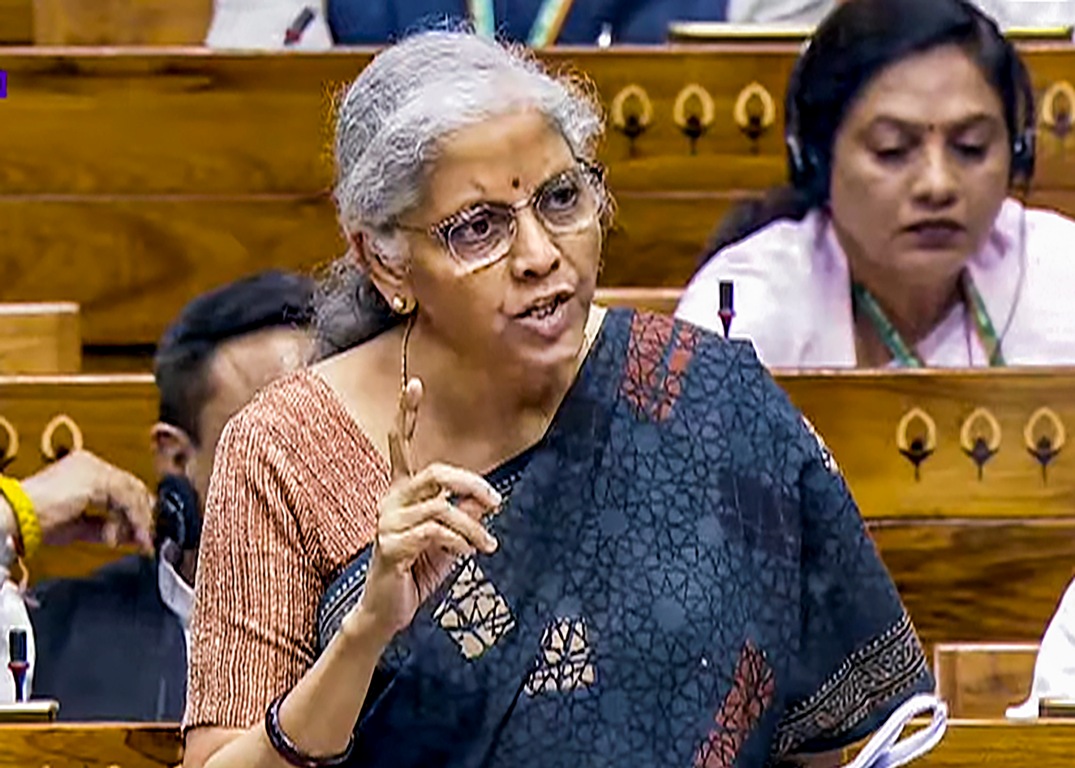

"Among these choices, focusing on FDI from China seems more promising for boosting India's exports to the US, similar to how East Asian economies did in the past," the Survey, tabled in Parliament by Nirmala Sitharaman on Monday, said.

Moreover, choosing FDI as a strategy to benefit from the China plus one approach appears more advantageous than relying on trade.

"This is because China is India's top import partner, and the trade deficit with China has been growing. As the US and Europe shift their immediate sourcing away from China, it is more effective to have Chinese companies invest in India and then export the products to these markets rather than importing from China, adding minimal value, and then re-exporting them," it added.

The survey explained how increased FDI inflows from China can help in increasing India’s global supply chain participation along with a push to exports.

At present, FDI from China in any sector needs government approval.

China stands at 22nd position with only 0.37 per cent share (USD 2.5 billion) in total FDI equity inflow reported in India during April 2000 to March 2024.

Capital markets are becoming more prominent in India's growth story, with an expanding share in capital formation and investment landscape on the back of technology, innovation and digitisation, according to the Economic Survey 2023-24 tabled in Parliament on Monday.

Further, Indian markets are resilient to global geo-political and economic shocks.

Despite heightened geopolitical risks, rising interest rates and volatile commodity prices, Indian capital markets have been one of the best performing among emerging markets in FY24, the Economic Survey said.

The BSE benchmark Sensex has surged around 25 per cent in FY24. Moreover, the uptrend continued in FY25, with the 30-share index on July 3 touching the 80,000 mark in intra-day trading for the first time.

"The exemplary performance of the Indian stock market compared to the world and emerging markets over the years can be primarily attributed to India’s resilience to global geo-political and economic shocks, its solid and stable domestic macroeconomic outlook, and the strength of the domestic investor base," said the document tabled by Finance Minister Nirmala Sitharaman in Parliament.