Indians got wealthier faster than peers in most countries, yet, inequality remains stark. According to the report, “While wealth has been rising in India, not everyone has shared in this growth. There is still considerable wealth poverty, reflected in the fact that 92 per cent of the adult population has wealth below $10,000,” Credit Suisse Research Institute’s Report,2017 said.

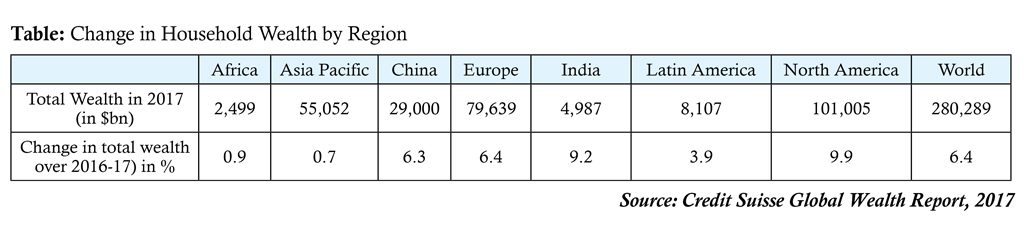

Total wealth here has risen four-fold between 2000 and 2017, reaching$5 trillion in mid-2017. Wealth in India has grown 9.2 per cent per annum, faster than the global average of 6 per cent even when taking into account population growth of 2.2 per cent annually. That’s a yearly rise of 9.9 percent, second only to the 10.1 percent growth seen in the U.S. Share of wealth fails to match the population share as the population share exceeds the wealth share by a factor of almost 10 in the country. The average wealth per adult here is estimated at $5,980 in mid-2017.

Wealth in India grew 9.9% in the past 12 months to touch $5 trillion in mid-2017, Credit Suisse Research Institute’s 2017 Global Wealth Report showed. India’s wealth growth of $451 billion is the 8th largest wealth gain globally by any country. The number of millionaires in India grew 21.3% to reach 2, 45,000 in mid-2017, owning $988 billion. Among them, ultra high net worth individuals grew 41.5% to 1,820, which is ranked 14th globally

India was the second-most unequal country in the world in terms of distribution of wealth. India not only has one of the highest levels of inequality in the region, but it also shows very large increases in inequality since 1990. Over the next 20 years, 500 people will hand over $2.1 trillion to their heirs — a sum larger than the GDP of India, a country of 1.3 billion people. In India, the richest 1% own 53% of the country’s wealth, according to the latest data from Credit Suisse. The richest 5% own 68.6%, while the top 10% have 76.3%. At the other end of the pyramid, the poorer half jostles for a mere 4.1% of national wealth. Indian millionaires control around 45% of total wealth in India. Indians make up a chunk of the world’s poorest population, Residents of India are heavily concentrated in the lower wealth strata, accounting for over a quarter of people in the bottom half of the distribution, the poorest 10 per cent have seen their share of income fall by more than 15 per cent.” the Credit Suisse report said.

What needs to be done?

It is time to build a human economy that benefits everyone, not just the privileged few. Government must be employer and more jobs created for the poor. Others measures needs to be taken for reducing the inequality, such as more progressive taxation, introducing an inheritance tax, not reducing the corporate tax rates, increased spending in healthcare and education, and resurrecting small and medium enterprises. Income redistribution is achieved by fiscal policy mainly, but it does not limit itself to income transfers from the rich to the poor. In informal markets, fiscal incentives for poorer entrepreneurs can encourage them to enter the formal sector, provide social security for them, and they make easier to pay taxes according to status and profits. On the other hand, fiscal incentives for banks can encourage them to lend money to poor people, providing guarantees of payment and creating funding programmes targeted to the poorest deciles.

Prof Mithilesh Kumar Sinha

Finance Officer

Nagaland University, Lumami